By Jenny McCall, Bloomberg Live

At Day 2 of Bloomberg’s Navigating Markets 2020 event on November 6th, led by Dana El Baltaji and Liz McCormick, a series of conversations were had with key voices and leaders in the financial markets and equities space. Speakers included:

- Dana El Baltaji, Team Leader FX/Rates EMEA, Bloomberg News

- Jane Foley, Head of FX Strategy, Rabobank

- Christoph Hock, Head of Multi-Asset Trading, Union Investments

- Mike Pyle, Global Chief Investment Strategist, Blackrock

- Eden Simmer, Executive Vice President, Head of Global Equity Trading, PIMCO

- Tim Craighead, Senior European Strategist and Director of Research – Content, Bloomberg Intelligence

- Liz McCormick, Senior Reporter Rates/FX, Bloomberg News

Click here to view video of the full discussion.

A few of the key takeaways:

- There were various compliance issues that hindered traders from working from home, Eden Simmer, Executive Vice President, Head of Global Equity Trading, PIMCO said. “We did detailed scenario planning ahead of the lockdown and our trading is done over mediums that can be audited. So now that you know there’s a nice audit trail to go back on and be able to reference, especially when markets are volatile as they are.”

- Jane Foley, Head of FX Strategy, Rabobank said that the pandemic may lead to more traders working from home once things start to return to normal. “I was speaking yesterday to our head of trading and he questioned whether traders would have to come back into the office full time. Why should it be? It’s proven that we can work from home, everything that we do is being monitored, and some of the traders perhaps like the flexibility to work from home. Maybe those who have young children or other caring duties, why should they be told when they have to be back in the office? ”

- Christoph Hock, Head of Multi-Asset Trading, Union Investments, echoed the sentiments of Jane and Eden by saying, “Prior to the covid-19 crisis we were set up for home working. We are a global asset manager business that is predominately based in Frankfurt, so from a trading perspective, we cover all time zones from Asia to Europe and America. Already in the past we were making use of working from home or trading from home, so it wasn’t a big, radical shift for us.”

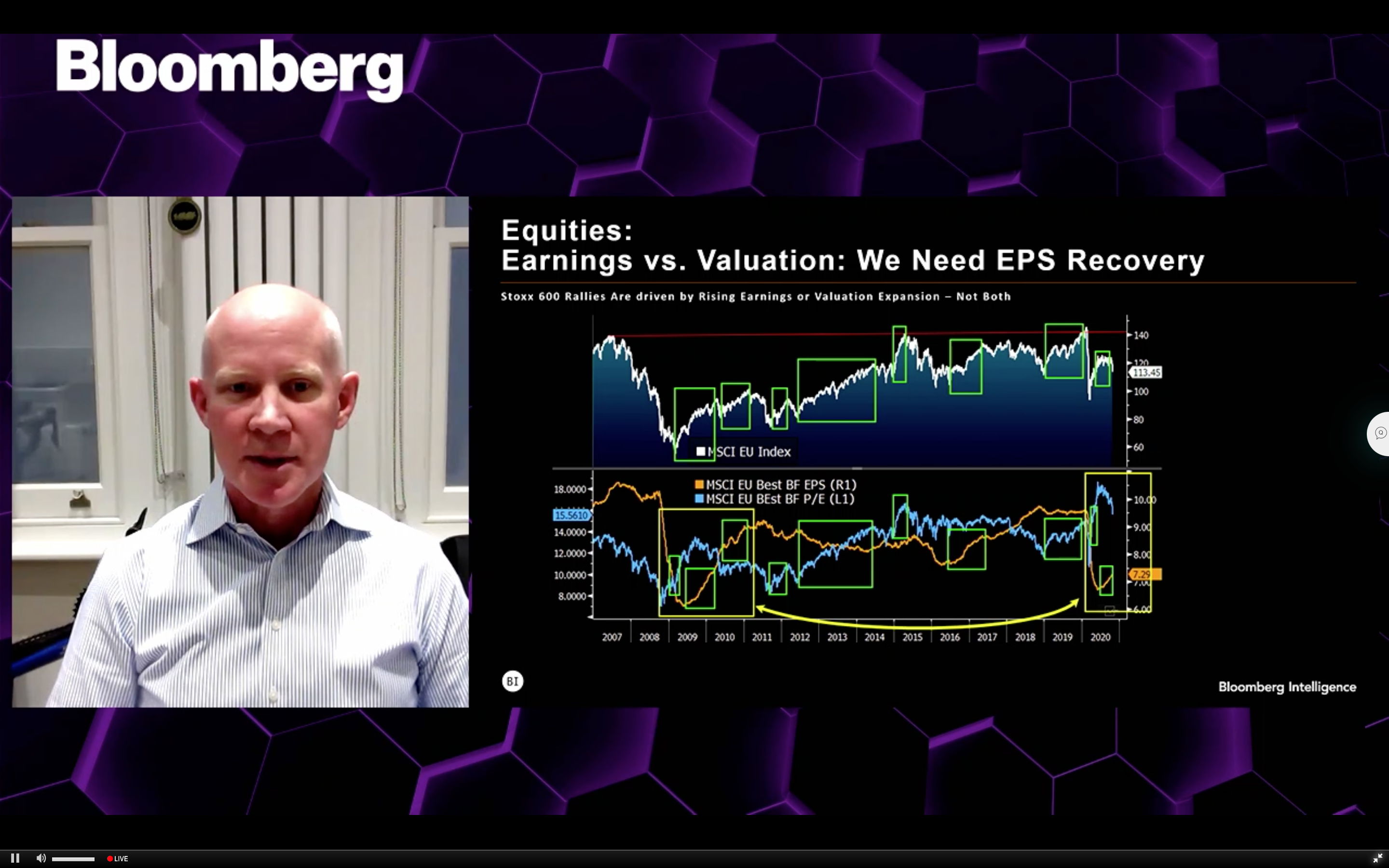

- Tim Craighead, Senior European Strategist and Director of Research – Content, Bloomberg Intelligence said, “I’d like to think a little bit about what is driving the European equity market from a broad-based perspective, and you can see we have seen some major positive moves in the equity market. The key drivers are earnings or valuation, that propelled the market to these high levels. It’s never really both earnings and valuation. The market currently has been driven by earnings.”

- Mike Pyle, Global Chief Investment Strategist, Blackrock said, “We are seeing globally in Europe, the U.S. and elsewhere a greater willingness of consumers to maintain a degree of mobility of engagement and kind of commerce and consumption in a way that wasn’t seen in the Spring and I think this reflects the confidence consumers now have that there is some basic level of normalcy.”

- “Public health challenges with the virus and other things, pointed out that this is going to be a period of months of peril for the U.S. economy before we get to 2021, then hopefully we will have more positive news with the vaccine and timelines around manufacturing and distribution and then we can start to see more normalization within the economic and social activity,” Pyle said.

Bloomberg’s Navigating Markets 2020 was Proudly Sponsored By

——————————

Join the Conversation: #NavigatingMarkets

Instagram: @BloombergLive

LinkedIn: Bloomberg Live

Twitter: @BloombergLive

Interested in more Bloomberg Live virtual events? Sign up here to get alerts.

——————————